SOAP - Basic Setup

SOAP is currently the default (and preferred) mechanism to invoke AvaTax APIs. The SOAP APIs have better support for some features, including currency.

Now that you have the Tax module included with your project, you will need to pass your credentials to the module in order to make tax calls. You can do this two ways, fill out the SQL tables manualy (Recommeneded for development) or use the admin to manage your configuration.

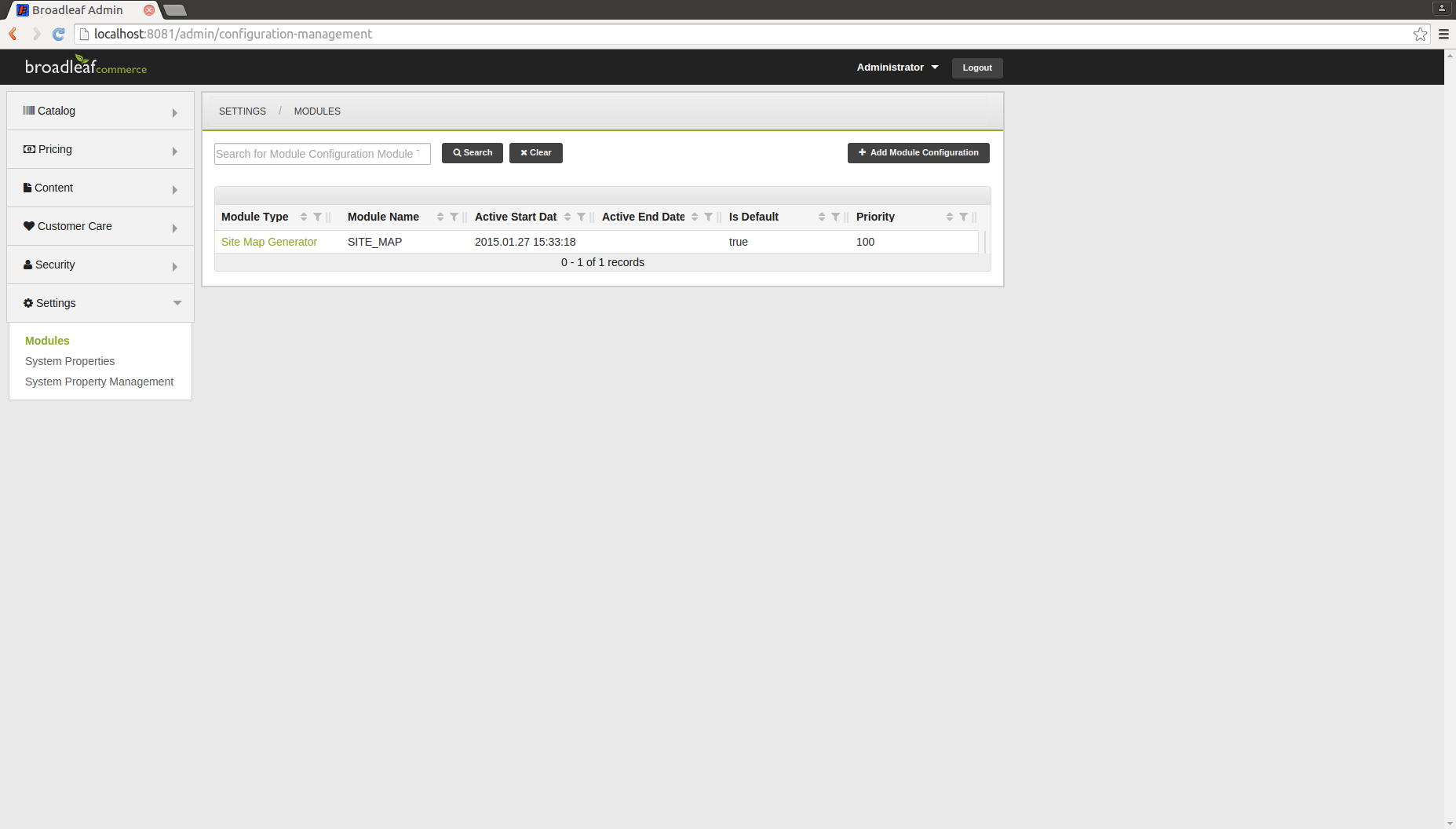

In the Admin, navigate to Settings / Modules:

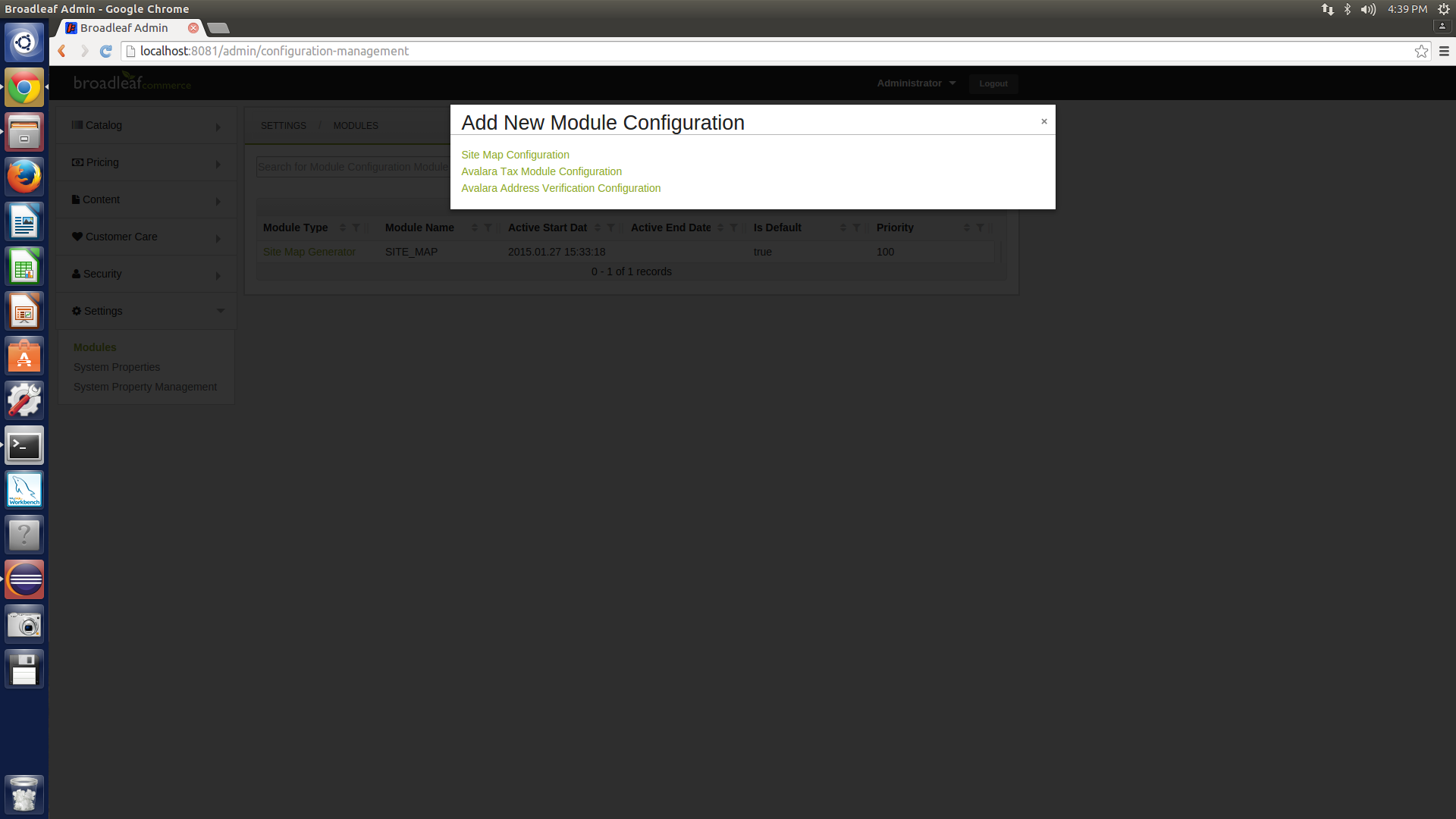

Click Add Module Configuration and select Avalara Tax Module Configuration:

In this case the Configuration Type will be Avalara Tax Module Configuration. (Note that Avalara can also be used as an Address Verification Module)

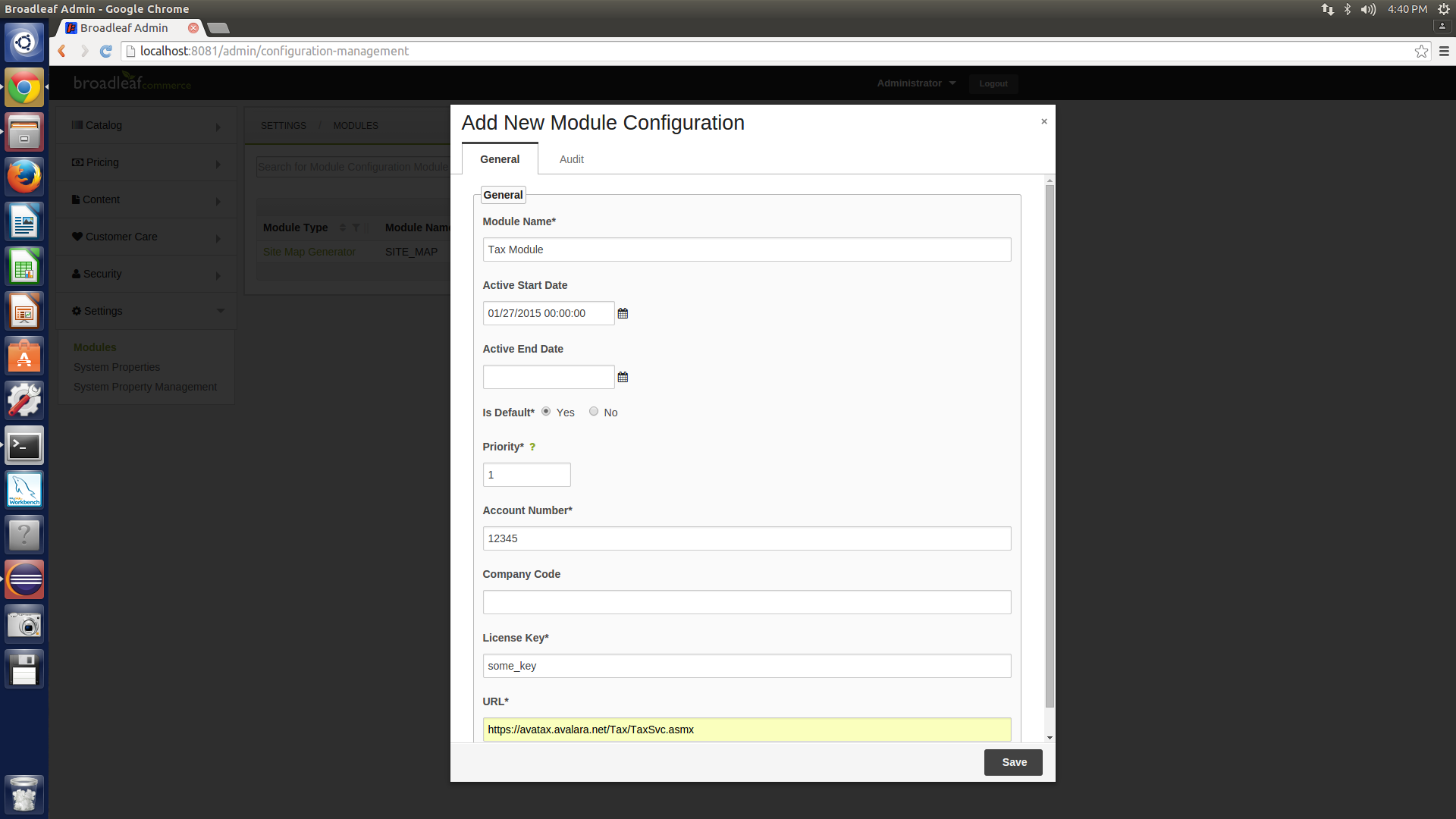

Fill out connection and credential information:

Since this is initial setup, you will want to set the Is Default and Is Active Flags to true.

- These are set in place in the event that the use has multiple modules of the same type available. For example : If multiple Tax Calculation Modules are active, the frame work will search for the default configuration and use that for calculations. If the default can not be used, it will move on to the next available configuration.

Module name is left to the user to define, this will be the name displayed in the list of configurations that you may have.

Account Number Will be the Account number given to you from your Avalara Admin Console (For a developer account this will be your Login)

License Key Will be the License Key given to you by Avalara. This is resettable with in the Avalara admin consol. (For a developer account this will be your password)

URL Will be a partial url defined by Avalara used to make tax calls. The module uses this url with appended identifiers based on what type of tax call you will be making. (Development : https://development.avalara.net/Tax/TaxSvc.asmx) (Production : https://avatax.avalara.net/Tax/TaxSvc.asmx)

Click Save.

You can test your connection to Avalara by clicking "Test Connection" after you save your configuration.

Now, Avalara should be configured to begin calculating taxes.

Some additional things to note:

- The Broadleaf Avalara module calculates taxes on a per Fulfillment Group basis

- The Broadleaf Avalara module will not attempt to calculate taxes if there is no address associated with a Fulfillment Group

- There is an activity to "commit" taxes to Avalara on the completion of an order. The order ID, by default, is uses as the document ID. You cannot commit the same document ID more than once. If you are using the same Avalara account in multiple environments (e.g. development and QA), make sure that the order ID sequences are different in these environments or see the Order ID section of [Customizing Requests(Avalara-Customizing-Requests)].